______________________________________________________________________ Business owners desiring liquidity but also maintaining control over and the independence of their company should definitely consider an ESOP. Compared to a sale to a 3rd party buyer, an ESOP transaction gives more flexibility to the sellers, significant tax benefits, and a higher degree of certainty that the transaction will occur. __________________________________________________________________

Astute observations from NCEO:

Selling to your employees can mean flexibility and fair market value for you, security for your workforce and community, and the deep satisfaction of knowing the people who will be responsible for your company’s success after you have left.

___________________________________________________________________

Business owners have many challenges that compete for their time. A Principal Financial study of small business owners showed some surprising disconnects between objectives and actions.*

Business owners have many challenges that compete for their time. A Principal Financial study of small business owners showed some surprising disconnects between objectives and actions.*

- The economic downturn has forced many owners to focus more on the short-term to the detriment of long-term business and personal goals.

- Protecting business value is the #1 priority of owners but only 30% of owners have a business protection plan in place. Such a risk protection plan could include:

- “Key man” life and disability insurance on critical executives that pays the benefit to the company;

- Succession plan;

- Employment agreements;

- Business continuity and all other applicable risk insurance; and

- Backup and safeguarding of records/data.

- Owners have not utilized approaches to assure an income stream in event of death or disability that also minimizes taxes.

- Only 8% have an Irrevocable Life Insurance Trust to remove sizable insurance proceeds from the owner’s estate.

- Only 15% have a Family Trust (i.e., Marital By-Pass Trust) to minimize estate taxes.

- When buying a disability policy, it should be purchased by the owner with after-tax proceeds (not by the company) so that any disability payments to the owner are non-taxable.

While 45% plan to retire within five years, only ¼ have an exit or succession plan.

The transition from active executive to retiree can be challenging.

- Of those with an exit plan, few have “funded” it with life and disability insurance.

- About 30% say they do not plan to retire. Is this realistic? Interestingly, this % also is rising for the average worker, but in that case because they don’t think they will be able to afford to retire.

- Succession plans are more than just a method for transferring ownership. A good plan can be the starting point for identifying and developing talented employees throughout all parts of your business.

- Only 40% have had a business valuation. Thus, the owner’s concept of business value may not comport with the current marketplace.

- According to a survey by Sunbelt Business Advisors, 84% of former business owners said they were depending on sale proceeds to fund their retirement but only 40% felt they successfully sold their business, and just 10% believed they even got close to receiving fair market value for their business.

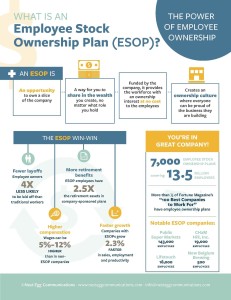

Is there a single solution for all these issues? No, but the good news is that many of these issues can be solved and that an ESOP can help maximize the value of the owner’s business interest via liquidity for the owner’s shares. Many business owners have 80% or more of their net worth tied up in their company. Moreover, the ESOP is often the first step in focusing on and unlocking this “value” while putting together a comprehensive succession plan. An ESOP can help you manage the tradeoff between control and value creation by giving you the best of both worlds without cashing in all your chips.*

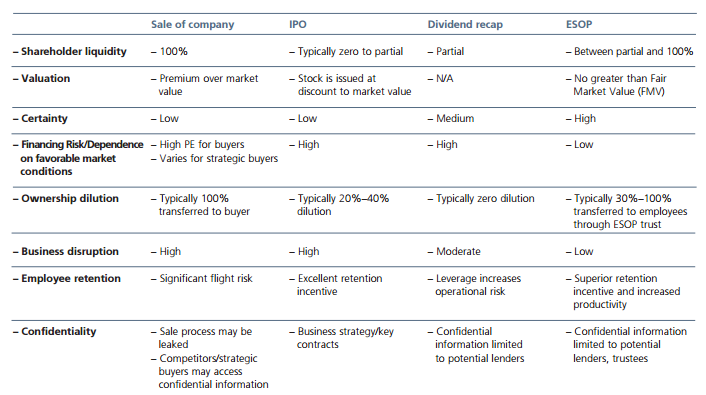

Think an ESOP is too complex and it would be much easier and cheaper to just put your business up for sale? Not so. See this excellent comparison chart from the NCEO. http://www.nceo.org/articles/esops-complexity-selling-business

_____________________________________________

Remember: It’s not how much you get, it’s how much you net.

_____________________________________________

Numerous academic research concludes ESOP companies outperform their peers. For example, EY’s Quantitative Economics and Statistics Practice (QUEST) showing that S-Corporation ESOPs vastly outperform the S&P 500. QUEST, in analyzing S ESOP filings covering the years 2002 to 2012, found the employee owned companies delivered their worker-owners an 11.5% compound annual growth rate vs. 7.1% for the S&P 500 on a total return basis.

We’re happy we put in an ESOP! See ESOP Association survey below.

http://www.esopassociation.org/docs/default-source/press-release-docs/summary-of-results-from-2000—2015-.pdf?sfvrsn=0

Why ESOPs work for owners and employees. http://www.ozy.com/pov/why-you-should-let-your-employees-own-your-company/70807

ESOPs can provide more retirement income than 401(k)s. Read more about the problems with 401(k) plans for the typical participant.

http://www.epi.org/publication/retirement-in-america/

More on ESOP by the Numbers from NCEO. http://www.nceo.org/articles/esops-by-the-numbers

A helpful chart from the folks at UBS comparing other exit strategies with an ESOP.

Contact Us to learn more about ESOPs and business transition strategies.

*http://www.principal.com/about/news/documents/businesspriorities_whitepaper.pdf